Candlestick Chart Pdf mzaeryellow

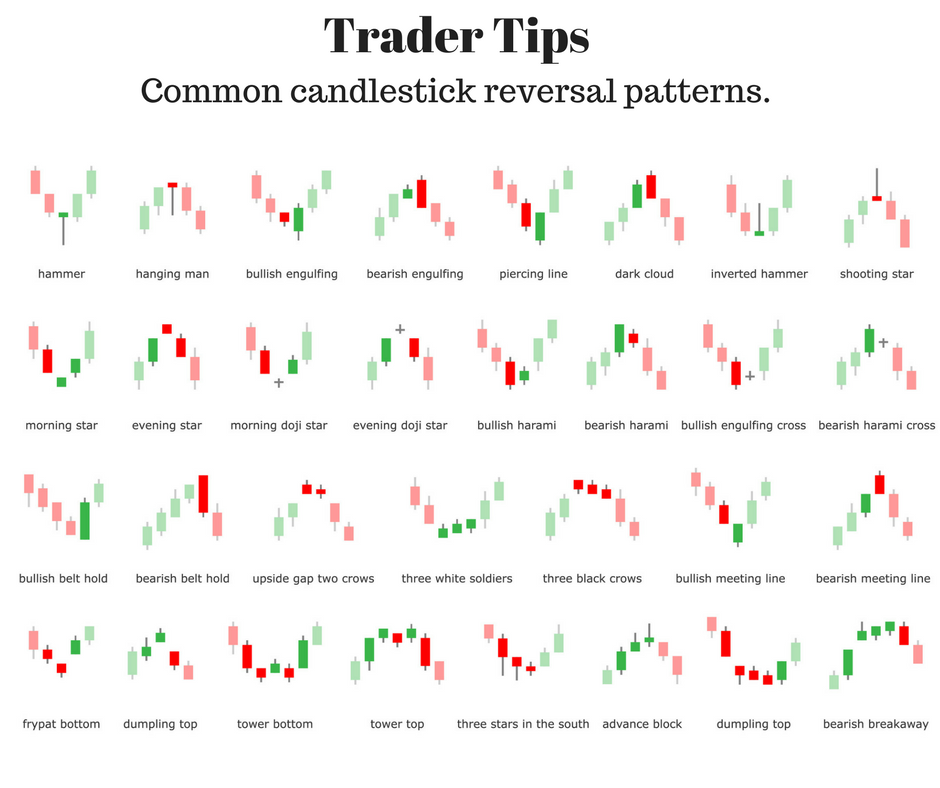

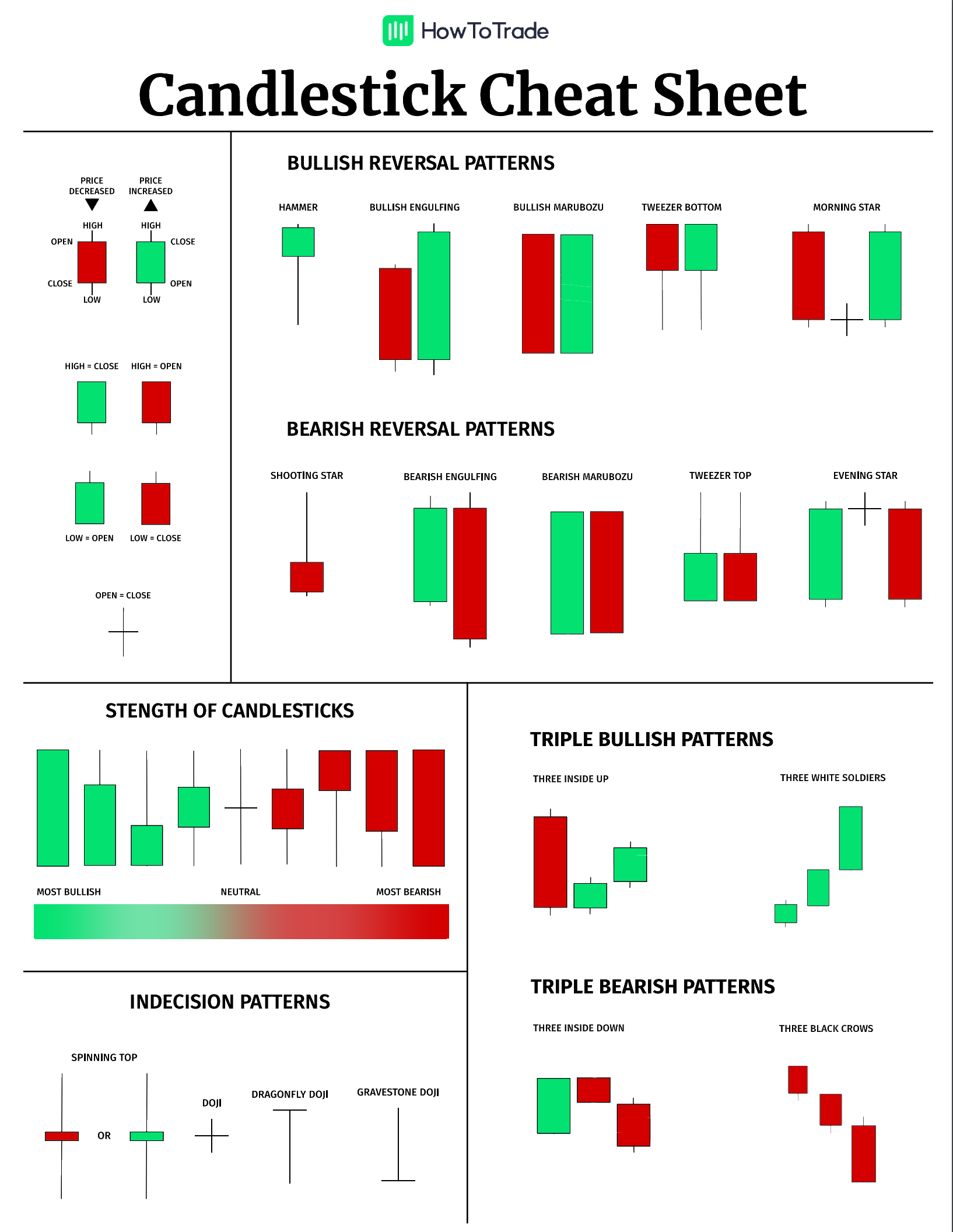

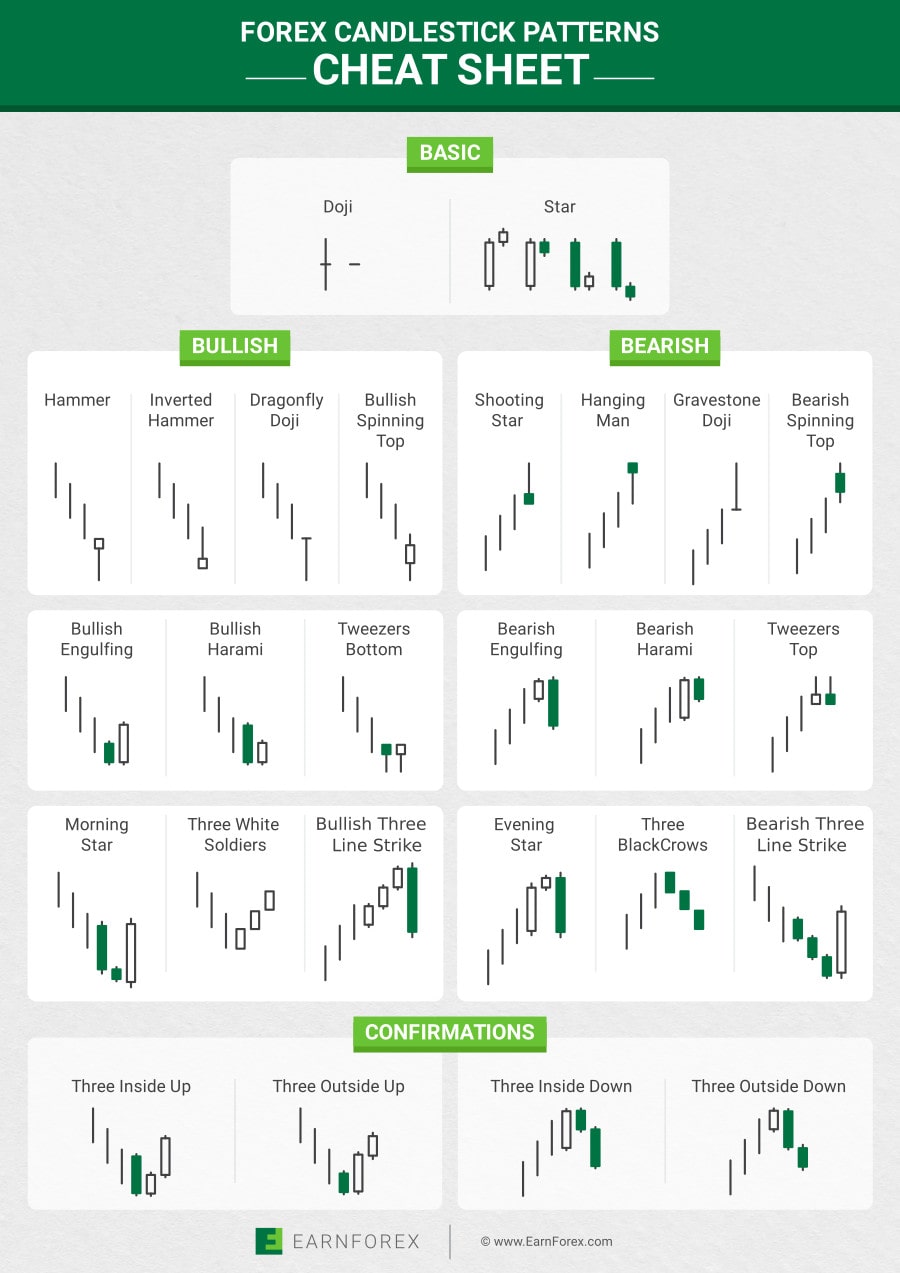

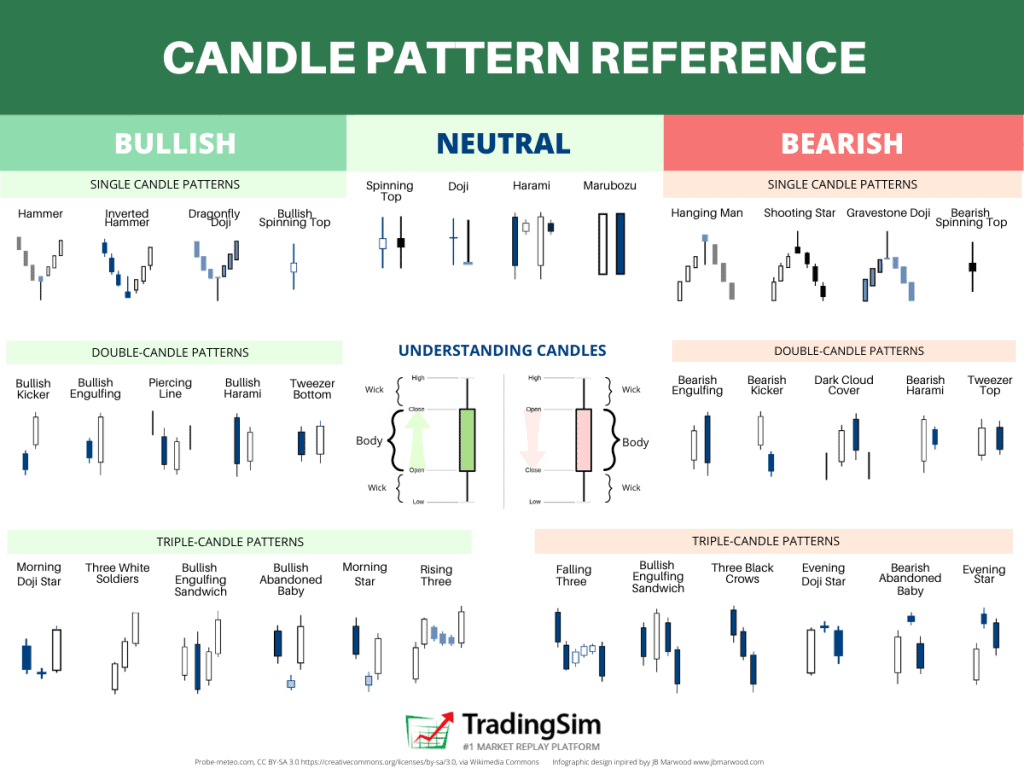

Candlestick patterns are one of the oldest forms of technical and price action trading analysis. Candlesticks are used to predict and give descriptions of price movements of a security, derivative, or currency pair. Candlestick charting consists of bars and lines with a body, representing information showing the price open, close, high, and low.

Printable Candlestick Patterns Cheat Sheet Pdf Printable Templates

Candlestick charts are a type of technical charts which analyses further price movement similar to the bar charts or line charts. Each candlestick is mainly made up of real body and wicks also known as shadows or tails. The opening price of the asset > closing price = Open will be at the top of the candlestick body.

Candlestick Pattern Cheat Sheet Bruin Blog

Dragon Fly DOJI - A Doji with the open and close at the bar's high. Long Legged DOJI - A Doji with long upper and lower shadows. The Individual Candles. Spinning Top - A bar with a small body and small range, after a multi-bar move. High Wave - A bar with a small body and wider range, after a multi-bar move.

Candlestick chart patterns cheat sheet pdf aslclip

Candlestick Charting (PDF) 2008 • 363 Pages • 11.26 MB • English. + candlestick + chart patterns + for dummies + candlesticks. Posted March 14, 2021 • Submitted by batz.rebecca. Facebook.

Japanese Candlestick Patterns In a Nutshell [Cheat Sheet Included]

Morning Star Pattern: The morning star pattern is a bullish reversal pattern. The morning star candlestick consists of 3 candles. The first is a bearish candle, the second is Doji, and the third is a bullish candle representing the buyers' power. Piercing Pattern: The piercing pattern is a bullish reversal pattern.

printable candlestick patterns cheat sheet pdf Google Search Stock chart patterns

QUICK REFERENCE GUIDE CANDLESTICK PATTERNS Dark Cloud Cover Bearish two candle reversal pattern that forms in an up trend. Bearish Engulfing Bearish two candle reversal pattern that

Candlestick Patterns And Chart Patterns Pdf Available BEST GAMES WALKTHROUGH

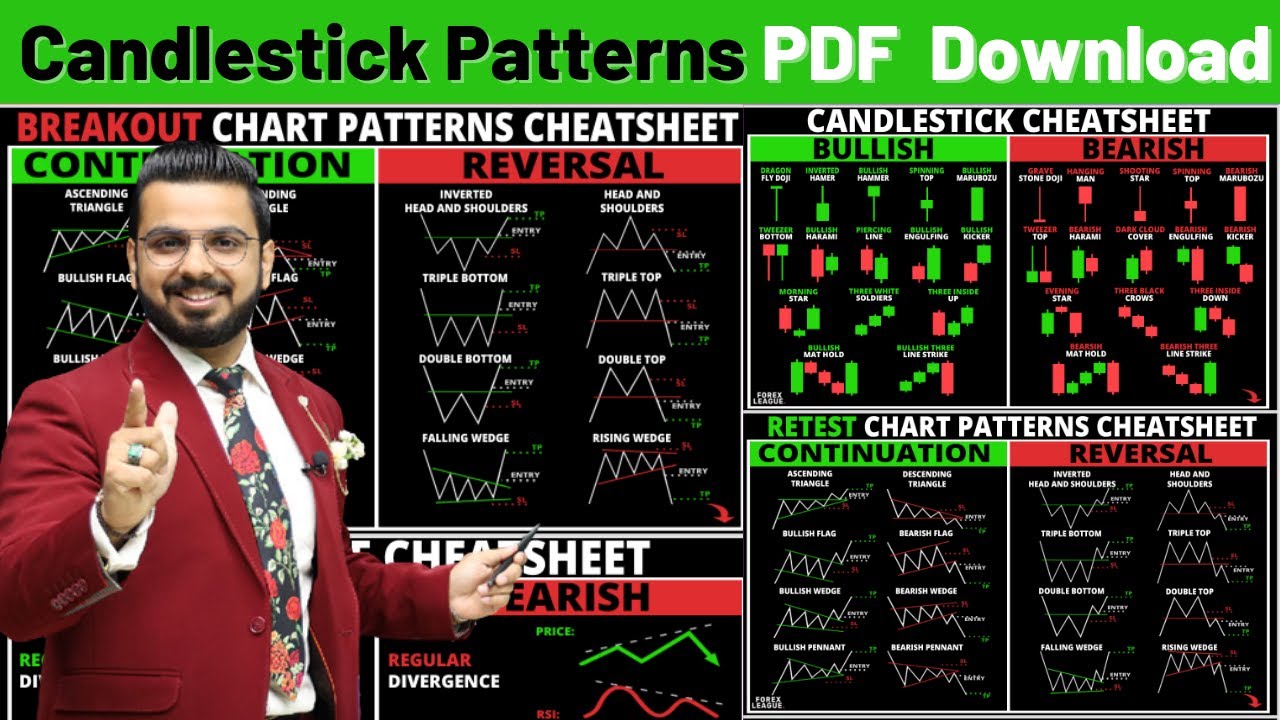

Japanese candlestick patterns are the modern-day version of reading stock charts. Bar charts and line charts have become antiquated. Candlesticks have become a much easier way to read price action, and the patterns they form tell a very powerful story when trading. Japanese candlestick charting techniques are the absolute foundation of trading.

Major Advanced Candlestick Patterns You Never Heard for BITSTAMPBTCUSD by GoldenEngine

In-neck Candlestick Pattern. Definition: The In-neck Candlestick Pattern is a bearish continuation pattern occurring in a downtrend. It consists of a long bearish candle followed by a smaller bullish candle that closes near the low of the previous candle. Signal: Indicates the continuation of the current downtrend.

Forex Candlestick Patterns Cheat Sheet

4. Three Inside Up Chart Pattern. The three inside down is a bullish trend reversal chart pattern made of three consecutive candles - a long bearish candle, followed by a bullish green candlestick that is at least 50% of the size of the first candlestick and a third candle that closes above the second candle.

Forex Candlestick Patterns Cheat Sheet

C o n t e n t s Chapter 1. What is a candlestick chart? Chapter 2. Candlestick shapes: Anatomy of a candle Doji Marubozo Chapter 3. Candlestick Patterns

Candlestick Patterns And Chart Patterns Pdf Available BEST GAMES WALKTHROUGH

30. Upside Tasuki Gap: It is a bullish continuation candlestick pattern which is formed in an ongoing uptrend. This candlestick pattern consists of three candles, the first candlestick is a long-bodied bullish candlestick, and the second candlestick is also a bullish candlestick chart formed after a gap up.

Forex Candlestick Patterns Cheat Sheet Pdf Fast Scalping Forex Hedge Fund

1 | P a g e A HANDBOOK OF TECHNICAL ANALYSIS CONTENTS Introduction 3 CHAPTER - 1 5 Types of Charts 5 1.1: Line Charts: 6 1.2: Bar Charts: 7 1.3: Candlestick Chart: 7 CHAPTER - 2 9 Trends 9 2.1: Market Trend and Range-Bound Consolidation: 10 2.2: Trendline & Channels: 12 2.3 Role Reversal: 14 2.4: Channels 14 CHAPTER - 3 16 Volume 16 CHAPTER- 4 19 Classical Chart patterns 19 4.1: Head and.

Japanese Candlestick Patterns Cheat Sheet Pdf Candle Stick Trading Vrogue

Unlike the previous two patterns, the bullish engulfing is made up of two candlesticks. The first candle should be a short red body, engulfed by a green candle, which has a larger body. While the second candle opens lower than the previous red one, the buying pressure increases, leading to a reversal of the downtrend. 4.

Candlestick Patterns Bruin Blog

Identify the various types of technical indicators including, trend, momentum, volume, and support and resistance. Identifying Chart Patterns with Technical Analysis. Use charts and learn chart patterns through specific examples of important patterns in bar and candlestick charts. Managing Risk with Technical Analysis.

Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim

In the example above, the proper entry would be below the body of the shooting star, with a stop at the high. 5. Indecision Candles. The doji and spinning top candles are typically found in a sideways consolidation patterns where price and trend are still trying to be discovered. Indecision candlestick patterns.

What Are Candlestick Chart Patterns? 5 Tips to trade

A candlestick pattern is a visual representation of price movements in a financial market, commonly used in technical analysis. Candlestick charts display price action for a given time period using individual candlesticks that represent the opening, closing, high, and low prices.